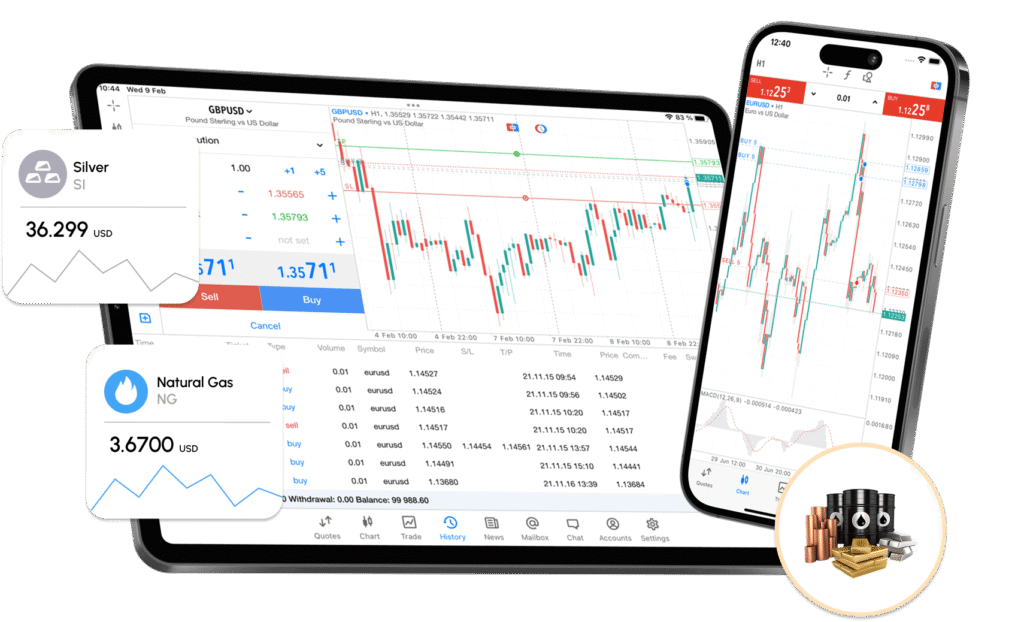

Unlock the potential of global commodities with TradeKaro. Whether you’re trading gold, silver, or copper, our platform offers seamless access to the world’s largest metals exchange—COMEX. Start trading with powerful tools, competitive margins, and expert insights, all designed to elevate your trading experience.

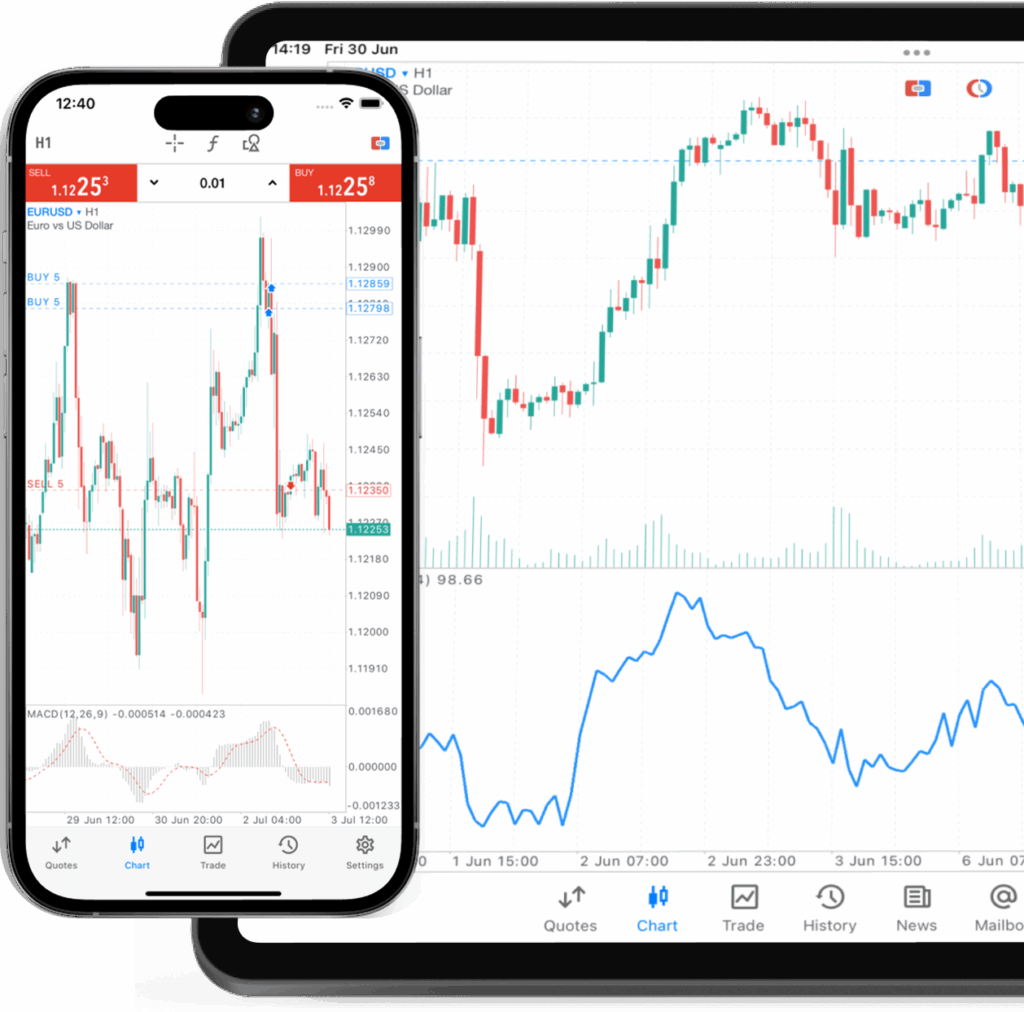

Trade international currency pairs directly in your local currency, avoiding the hassle of conversion.

Keep 100% of your profits—our platform charges no commissions on your earnings.

Explore a diverse range of over 50 currency pairs to broaden your investment opportunities.

Unlike other forex brokers, we offer trading with no spreads on currency pairs.

Our customer support team is available 24/7 in Hindi, Marathi, Gujarati, Tamil, Kannada, Telugu, Malayalam, and English.

Trade in currency of your choice INR or USD, avoid the hassel of conversion fees and trade calculations.

Keep 100% of your profits—our platform charges no commissions on your earnings.

Avail 500X Leverage to trade on your favourite assets now in Indian & International Markets.

Our customer support team is available 24/7 in Hindi, Marathi, Gujarati, Tamil, Kannada, Telugu, Malayalam, and English.

Our clients get access to our comprehensive trading courses worth Rs. 60,000 for free.

| SCRIPT | Name |

|---|---|

| GC | GOLD($) |

| SI | SILVER($) |

| NG | NATURALGAS($) |

| HG | COPPER($) |

| CL | CRUDEOIL($) |

Trading CFDs carries a high level of risk and may not be suitable for all investors. Leverage in CFD trading can magnify gains and losses, potentially exceeding your original capital. It’s crucial to fully understand and acknowledge the associated risks before trading CFDs. Consider your financial situation, investment goals, and risk tolerance before making trading decisions. Past performance is not indicative of future results. Refer to our legal documents for a comprehensive understanding of CFD trading risks. The information on this website is general and doesn’t account for your individual goals, financial situation, or needs.the Stock N Coin cannot be held liable for the relevance, accuracy, timeliness, or completeness of any website information. Our services and information on this website are not provided to residents of certain countries, including the United States, Singapore, Russia, and jurisdictions listed on the FATF and global sanctions lists. They are not intended for distribution or use in any location where such distribution or use would contravene local law or regulation. Stock N Coin is a brand name with multiple entities authorised and registered in various jurisdictions. Stock N Coin provides services globally, in compliance with the regulatory requirements of the respective consumer jurisdiction and in accordance with the legal library and license(s) possessed by the Stock N Coin structure.