The Indian Commodity Exchange is a premier exchange that facilitates the online trading of commodity derivatives. It is one of India’s most liquid and widely used commodity exchanges, offering a platform for traders to buy and sell contracts in various commodities such as metals, energy, and agricultural products.

Buy and sell Metals, Base Metals & Energies at a future date with contracts that have a specific expiry.

We offer a zero-commission trading environment, ensuring that you can trade any without incurring fees.

Trade with mini lots, reducing exposure and risk, allowing for better strategy management in smaller accounts.

Take advantage of 500X Intraday & 150X Holding leverage to trade your preferred assets in MCX

Our customer support team is available 24/7 in Hindi, Marathi, Gujarati, Tamil, Kannada, Telugu, Malayalam, and English.

Buy and sell Metals, Base Metals & Energies at a future date with contracts that have a specific expiry.

We offer a zero-commission trading environment, ensuring that you can trade any without incurring fees.

Take advantage of 500X Intraday & 150X Holding leverage to trade your preferred assets in MCX

Our customer support team is available 24/7 in Hindi, Marathi, Gujarati, Tamil, Kannada, Telugu, Malayalam, and English.

Trade with mini lots, reducing exposure and risk, allowing for better strategy management in smaller accounts.

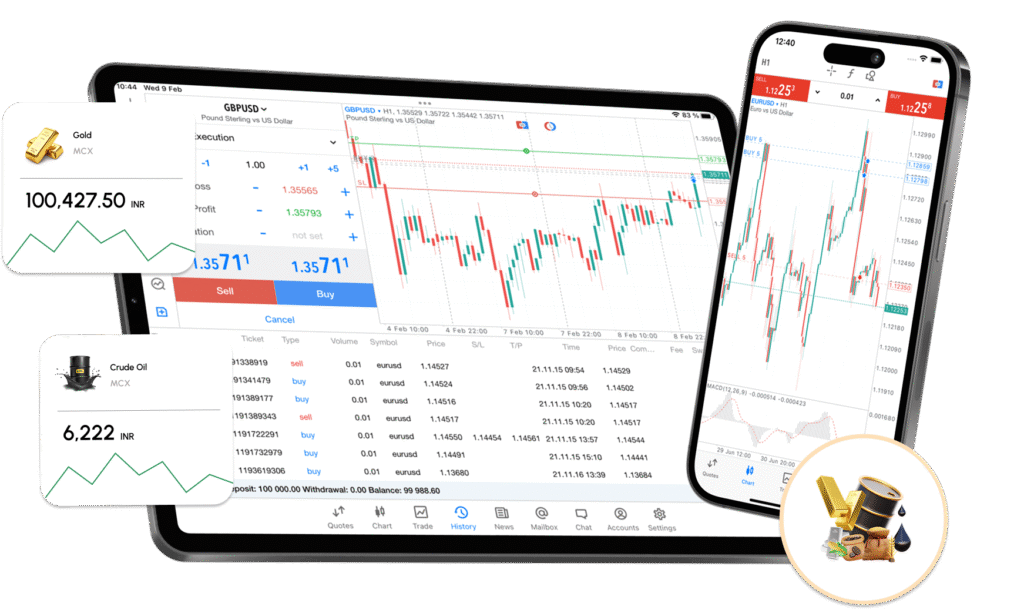

| GOLD MCX |

| SILVER MCX |

| ALUMINIUM MCX | COPPER MCX |

| LEAD MCX | ZINC MCX |

| NATURALGAS MCX |

| CRUDEOIL MCX |

On Indian Commodity Exchange, you can trade in a variety of commodities, including:

When you trade commodity futures on the Indian Commodity Exchange, you are entering into a contract to buy or sell a specific quantity of a commodity at a predetermined price on a future date. These contracts come with an expiry date, after which they must be settled.

Commodity options trading on Indian Commodity Exchange of India gives you the right, but not the obligation, to buy or sell a commodity at a specified price before the contract expires. This allows you to manage risk while taking advantage of price movements.

Indian Commodity Exchange of India trading hours are typically from 9:00 AM to 11:30 PM IST on weekdays. However, the exact timings may vary depending on the specific commodity being traded and the time of year (summer or winter timings).

The margin requirement on Indian Commodity Exchange varies depending on the commodity and the type of contract. Stocks N Coin offers leverage up to 500X, allowing you to trade larger positions with a smaller amount of capital.

No, Stock N Coin does not charge any commissions on Indian Commodity Exchange of India trades. We are committed to offering a zero-commission trading environment to provide the best trading solutions for our clients.

Trading CFDs carries a high level of risk and may not be suitable for all investors. Leverage in CFD trading can magnify gains and losses, potentially exceeding your original capital. It’s crucial to fully understand and acknowledge the associated risks before trading CFDs. Consider your financial situation, investment goals, and risk tolerance before making trading decisions. Past performance is not indicative of future results. Refer to our legal documents for a comprehensive understanding of CFD trading risks. The information on this website is general and doesn’t account for your individual goals, financial situation, or needs.the Stock N Coin cannot be held liable for the relevance, accuracy, timeliness, or completeness of any website information. Our services and information on this website are not provided to residents of certain countries, including the United States, Singapore, Russia, and jurisdictions listed on the FATF and global sanctions lists. They are not intended for distribution or use in any location where such distribution or use would contravene local law or regulation. Stock N Coin is a brand name with multiple entities authorised and registered in various jurisdictions. Stock N Coin provides services globally, in compliance with the regulatory requirements of the respective consumer jurisdiction and in accordance with the legal library and license(s) possessed by the Stock N Coin structure.